|

Getting your Trinity Audio player ready…

|

How to get a mortgage in America in 2023 (and how high rates are impacting affordability)

Buying a home is one of the biggest financial decisions you’ll ever make, and getting a mortgage is a key part of the process. A mortgage is a loan that you take out from a bank or other lender to finance the purchase of a home. You’ll repay the loan over time, plus interest.

Here’s a step-by-step guide on how to get a mortgage in America in 2023:

- Get pre-approved for a mortgage. This means that you’ll meet with a lender to discuss your financial situation and get an estimate of how much money you can borrow. Pre-approval shows sellers that you’re a serious buyer and that you’re qualified for a mortgage.

- Find a home and make an offer. Once you’re pre-approved, you can start shopping for a home. When you find a home you want, you’ll make an offer to the seller. If the seller accepts your offer, you’ll enter into a contract.

- Get a mortgage appraisal. The lender will order an appraisal to determine the value of the home. This is to make sure that you’re not borrowing more money than the home is worth.

- Close on the mortgage. Once the appraisal is complete and all of the paperwork is in order, you’ll meet with the lender to close on the mortgage. This is when you’ll sign the final loan documents and receive the money to buy the home.

How higher rates have affected people’s ability to buy a home in 2023

Mortgage rates have been rising steadily in 2023, and they’re now at their highest levels in over a decade. This is making it more expensive to borrow money to buy a home, and it’s pricing some buyers out of the market.

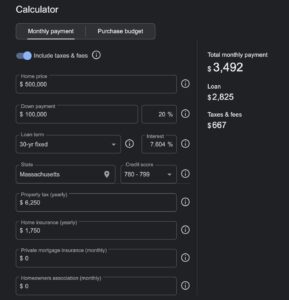

For example, the total monthly payment for a home in a case like the one shown below with a home price of 500k is $3,464 with an interest rate of 7.5% while the same house would have a total payment per month of $2,814 if the interest rate were 5%. This makes it impossible to buy a 500k home for many who cannot afford such a high monthly payment. It also means that you can afford a lot less house with the same available cash amount.

Now, in markets like the Boston area, 500k is actually really low and you won’t get many property options that are in that range. This is good to know if you are looking for a while and do come across a good deal by chance. Don’t go for bad deals is the other implicit advice here.

Remember you make money at purchase, not at sale. So if you purchase for less, you will make more money in the long run. If you overpay, then even with appreciation, you will likely lose money. Also, forget about upgrades when you buy if they are not absolutely needed. That will just tighten cash flow and if you go to sell, it will decrease your profit margin that much more.

Negotiating Closing costs when buying a home

Another recommendation when buying a home is if you do come across a home that seems like an actually good deal (not just priced low because it is in terrible condition), then perhaps you can try and get the seller to cover a majority of the closing costs. This will allow you to put more down towards the house and go less in debt. Since debt is so expensive now, it is important to lower debt even if that means less house and more negotiation. Every penny you can save and make towards the down payment, you should.

One way to do this is to offer the full amount or a competitive amount for the home, but write into the contract that you would like some amount (say 10k) towards closing costs. Then you can use some of those closing costs to buy down your interest rate with your lender and overall also have less closing costs and more money towards your down payment. Sometimes if you ask nicely who knows it might work. Everyone’s situation is tight these days, but the seller is the one who will have cash when there is a sale, so between the buyer and seller, I would imagine the seller would have more wiggle room.

Tips for buying a home in a rising rate environment

If you’re planning to buy a home in 2023, there are a few things you can do to make the process easier:

- Get pre-approved for a mortgage before you start shopping for a home. This will give you an idea of how much money you can borrow and what your monthly payments will be.

- Be prepared to make a larger down payment. A larger down payment will lower your monthly payments and make you more competitive in the housing market.

- Consider buying a less expensive home. If you’re struggling to afford your dream home, consider buying a less expensive home or buying in a less expensive neighborhood.

- Work with a qualified real estate agent. A real estate agent can help you find homes that fit your budget and needs, and they can also negotiate on your behalf.

Buying a home in a rising rate environment can be challenging, but it’s still possible. Hope some of these tips and recommendations help in the process. Do NOT skip the home inspection. Happy buying!

What if you waited…

Another parting thought is that even though interest rates are high now, we don’t know whether they will come down any time soon. When they do come down, there might be more competition for homes, and the dream home you are waiting on the sidelines for might actually be a lot harder to get then.

So, it is a tradeoff between just going for something now or waiting for a more suitable time. Sometimes I find waiting to be a tricky thing to do as it delays action and in this case, you might end up overpaying later. Whereas, if you can settle for a good price now, maybe you could refinance or pay down the principal later on.

Leave a Reply